Raising finance to buy a property at auction can be a nightmare.

Either you are unable to get a mortgage because the property requires major work or it is virtually impossible to secure a mortgage in the timeframe required.

But do you know there is a quick and easy solution?

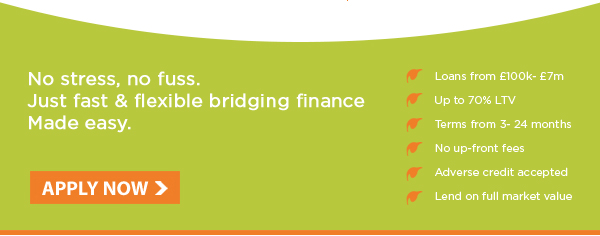

If you’re looking to buy at auction you can use bridging finance. A bridging loan is more flexible than a mortgage and lending decisions can be made within hours of initial enquiry so funds could be released in less than a day. A bridging loan will also allow you time to complete any renovations required to maximise the value of the property and obtain a mortgage at the right level. |

|

|

Case Study: Auction Purchase

Initial circumstances: A client needed £215,000 to complete an auction purchase, plus renovations. His usual lender couldn’t provide the finance for completion in time and so he faced losing his deposit.

MTF solution: MTF provided a £215,000 bridging loan, at 65% LTV over a 6 month term at 0.99% per month with no exit fee or early redemption penalty.

The outcome: MTF managed to provide the loan well within the 14 days prescribed, saving the client’s deposit. The client completed the work within 6 months and sold the property, enabling him to repay the bridging loan and enjoy a substantial profit. |

|